2025: Donald Trump’s New World Order

In 2024, we wrote: “The dominant theme of 2025 is likely to be geopolitical tensions. Behind the curtain, there will be a focus on the uncertainty caused by the disruptive impact of a second Trump presidency, particularly on immigration and trade.” That prediction has proven true. And yet, until now, the economy has remained strong, supported by a resilient job market, declining inflation, and accommodative monetary policy.

Still, a dark cloud has been looming for some time, driven by escalating trade tensions—even before the new tariffs were announced on “liberation day” on April 2. These measures are expected to inflate prices in the U.S., weighing on economic growth and increasing the likelihood of a recession.

Political uncertainty is running high. Confidence among consumers, businesses, and markets has been shaken, which helps explain the market pullback following Donald Trump’s re-election in November.

Markets in the First Quarter

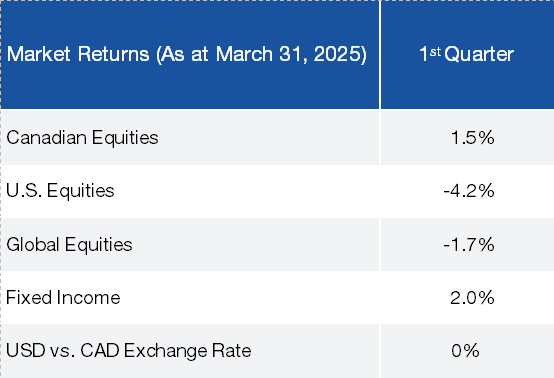

In the first three months of 2025, global equity markets declined by 1.7%. European equities posted a strong gain of 9%, while U.S. markets dropped by 4.2%. Value stocks outperformed growth stocks (+5.2% vs. -7.7%).

Technology and consumer discretionary sectors, particularly companies linked to artificial intelligence, were among the biggest drags on the U.S. markets. In contrast, resource-related sectors and defensive areas like utilities and consumer staples performed well.

In Canada, the materials sector (+20.3%), and especially gold stocks (+34.3%), drove the market higher, supported by a 17% surge in gold prices.Excluding gold stocks, the Canadian index would have posted a near 1% loss.

RETURNS ON MAJOR ASSET CLASSES (CAD)

Outlook for 2025

The announcement of “reciprocal” tariffs on April 2 sparked a sharp market reaction. The scope and scale of the Trump administration’s proposed tariffs—set to affect 185 countries—raise concerns about a broader economic slowdown. Higher prices in the U.S. could squeeze the American consumer, who accounts for nearly 70% of U.S. GDP and roughly 20% of global GDP.

In the coming months, investors will be adjusting their valuation models to reflect the impact of new trade tariffs on corporate profitability. The potential response from U.S. trading partners and the risk of an escalating trade war only add to market anxiety. Complicating matters further, President Trump—elected on a wave of public frustration over inflation and a weak economy—may soon face mounting pressure from his own base. This could prompt a shift in his stance.

All in all, equity markets are likely to remain highly volatile in the months ahead.

Investing for the Next Generation, Not the Next Quarter

Allard, Allard & Associés celebrates its 30th anniversary this year. As we enter this new decade of portfolio management, we maintain the same philosophy we had in 1995: to offer high-performing, prudent, and sustainable portfolios, by maintaining a long-term vision and a focusing on tangible financial results. This approach has served us well—especially during periods when markets had to lower their growth expectations, as appears to be happening now. We remain confident that this philosophy will continue to deliver superior long-term results through full market cycles.

Periods of market adversity are often a good time to reevaluate your risk tolerance and review your investment policy with your advisor.

Author(s)