When talking about risks related to financial markets, we usually think of volatility (standard deviation). Yet for many investors, the most concerning risk may be something entirely different: the risk of living longer than expected and depleting their retirement savings.

Longevity risk is often underestimated, even though it can have major consequences. It is the risk of outliving financial resources, or put another way,

running out of money before the end of life.

As life expectancy continues to rise and defined benefit pension plans become increasingly rare, this risk is growing in importance.

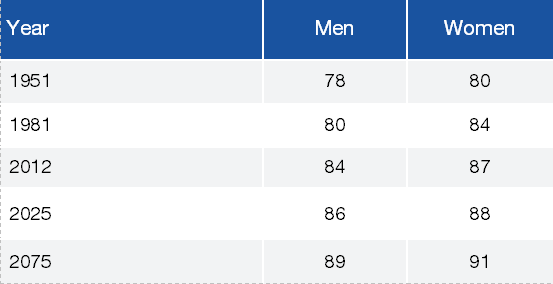

Thanks to medical advances, better nutrition, and widespread access to healthcare, people are living longer than ever. In the 1950s, a 65-year-old woman could expect to spend about 15 years in retirement, compared with 13 years for a man. Today, these figures have increased to 23 years for women and

21 years for men. That represents an increase of 55 percent in only three generations.

EVOLUTION OF LIFE EXPECTANCY AT AGE 65

Despite this improvement, surveys show that Canadians underestimate their retirement life expectancy by about four years on average.

What matters most are not the averages but the probabilities of living very long. For example, one in ten retired men and one in four retired women will reach age 95. In nearly 30 percent of couples retiring at age 65, at least one spouse will live to age 95, meaning hey will need to finance more than 30 years of retirement.

Defined benefit pension plans, which provide lifetime income, have become increasingly difficult to access. These plans pool longevity risk among participants. In so, those who live longer receive stable payments that are partly funded by those whose retirement is shorter.

For most Canadians who do not have access to these plans, the responsibility of planning and funding retirement rests entirely on their own shoulders. This reality significantly increases exposure to longevity risk.

Fortunately, longevity risk can be managed. At every stage of life, certain decisions have a direct and lasting effect:

During working years, it is essential to manage spending to promote saving. One must also seek to optimize income through career decisions, entrepreneurship, and smart investing.

When approaching retirement, delaying this transition allows for a longer accumulation period and reduces the number of years of retirement that must be financed.

During retirement, it is important to maintain a sustainable lifestyle and to keep investing appropriately, since the investment horizon can still be long.

To prepare effectively:

Start saving early to benefit from compounding

Avoid an overly conservative investment approach

Plan as if you will live a very long life

Delay government benefits (CPP or QPP and Old Age Security) when possible since they act as lifetime income sources

Longevity risk is very real. Living longer is wonderful news, as long as those extra years are funded. A disciplined plan, a thoughtful investment strategy, and a long-term perspective are essential.

This is exactly the foundation of our approach at Allard, Allard & Associés. We believe that strong, prudent, and sustainable portfolios are built on solid principles and disciplined management. For 30 years, our focus on high-quality, profitable, and resilient businesses has helped our clients navigate market cycles and major life transitions with confidence.

If you would like to review your retirement strategy or discuss your financial situation, please do not hesitate to contact us.