Since our beginnings in 1995, investing in equities has proven highly profitable for investors. Over this 30-year period, Canadian and U.S. stock markets have delivered total returns of approximately 1,100% (8.7% annually) and 1,950% (10.4% annually in USD), respectively.

And yet, markets have weathered many storms—crises that at times severely shook investor confidence. Here is a look back at some of the most notable ones:

Asian Financial Crisis (1997–1998): What began in Thailand quickly spread across Southeast Asia, affecting economies such as Indonesia, Malaysia, and South Korea. Currency collapses, capital flight, and a broad reassessment of risk laid bare the vulnerabilities of emerging markets. In the aftermath, Russia experienced a financial meltdown of its own in 1998, defaulting on its debt and triggering a sharp devaluation of the ruble.

Dot-Com Bubble (2000): At the turn of the millennium, enthusiasm for tech stocks drove valuations to unsustainable levels. The resulting speculative bubble burst in 2000, leading to a sharp market correction and a painful reassessment of internet-related company valuations.

September 11 Attacks (2001): The 9/11 terrorist attacks had an immediate and profound impact on global financial markets. Stock exchanges were suspended, and investor sentiment was deeply shaken.

Global Financial Crisis (2007–2008): Widely regarded as the worst crisis since the Great Depression, the 2008 crash originated from a U.S. housing bubble and the widespread securitization of subprime mortgages. The collapse of major institutions, notably Lehman Brothers in September 2008, triggered a domino effect across the global financial system and pushed many countries into recession.

European Sovereign Debt Crisis (2010–2012): Following the 2008 crisis, several eurozone countries, most notably Greece, but also Ireland, Portugal, and Spain, faced unsustainable debt levels. Questions about the stability and even the survival of the Eurozone soon emerged.

Chinese Stock Market Crash (2015): During the summer of 2015, Chinese equity markets experienced a sharp drop driven by growing concerns over the health of the Chinese economy.

COVID-19 Pandemic (2020): The global lockdowns triggered a dramatic market drop in March 2020. Extraordinary monetary and fiscal interventions led to a swift recovery, albeit one accompanied by a rethinking of economic priorities and the rise of remote work and digital technologies.

Beyond these major episodes, other factors have fueled ongoing anxiety in the markets over the past three decades. They can broadly be grouped into the following themes:

Geopolitical tensions and political uncertainty

Shifts in monetary policy and inflation concerns

Technological disruption and market volatility

Systemic risks and cybersecurity threats

While less spectacular than market crashes or global recessions, these forces contribute to a backdrop of chronic uncertainty. More recent examples include the outbreak of war in Ukraine in 2022, the conflict in Gaza in 2023, and the onset of a new tariff war marked by the so-called "Liberation Day" on April 2 of this year.

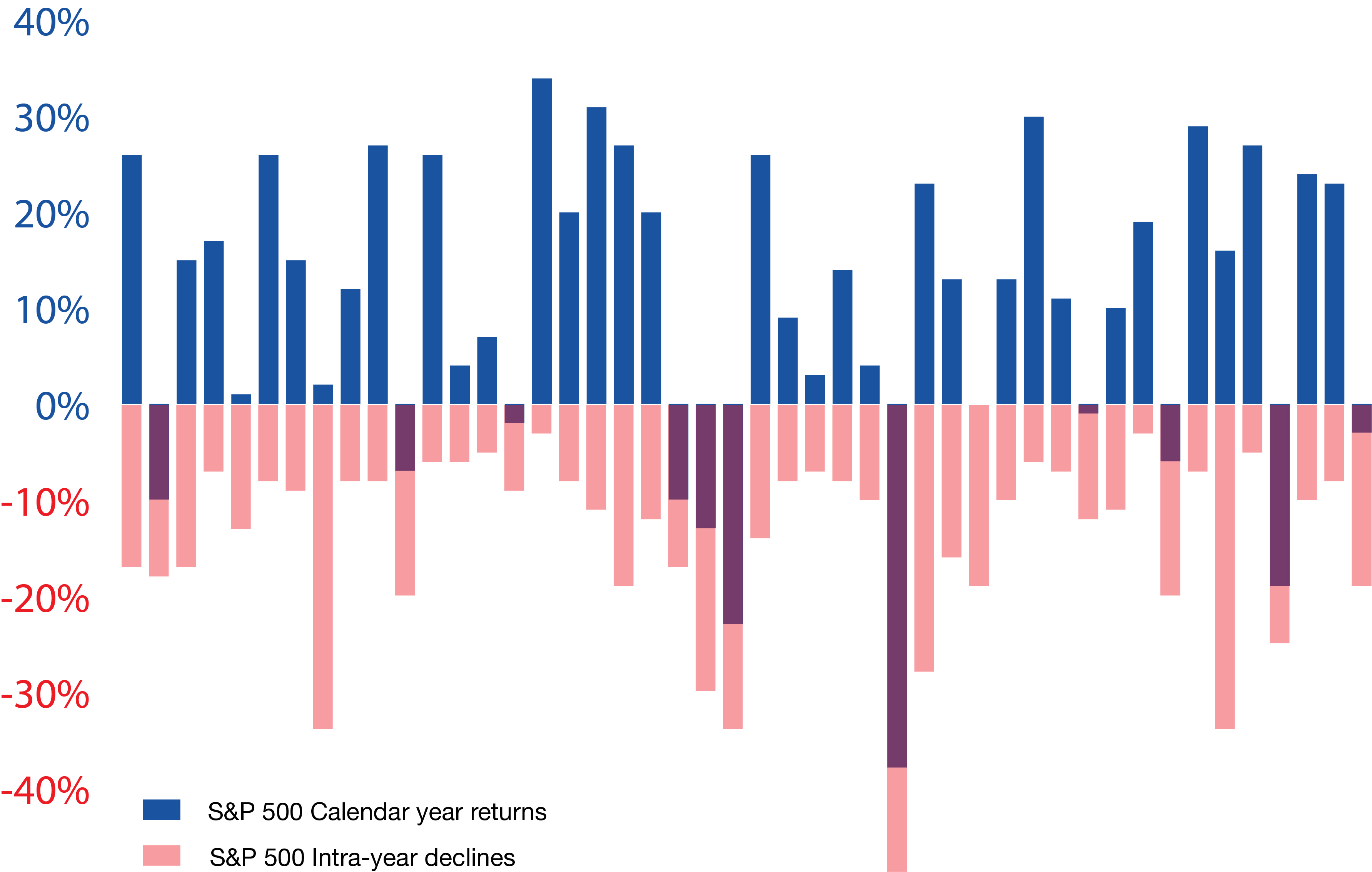

The chart opposite illustrates the annual return of the U.S. stock market (in USD) along with the maximum intra-year drawdown (from peak to trough) observed for each calendar year over the past 45 years. Unsurprisingly, the steepest declines align with crisis periods—nearly 50% in 2008 being the most severe. It is also worth noting that significant pullbacks occur every year, with an average intra-year drop of 14%.

S&P RETURNS AND INTRA-YEAR DELCINES

Source: JP Morgan

At its core, the stock market is an auction house where buyers and sellers trade shares of public companies.

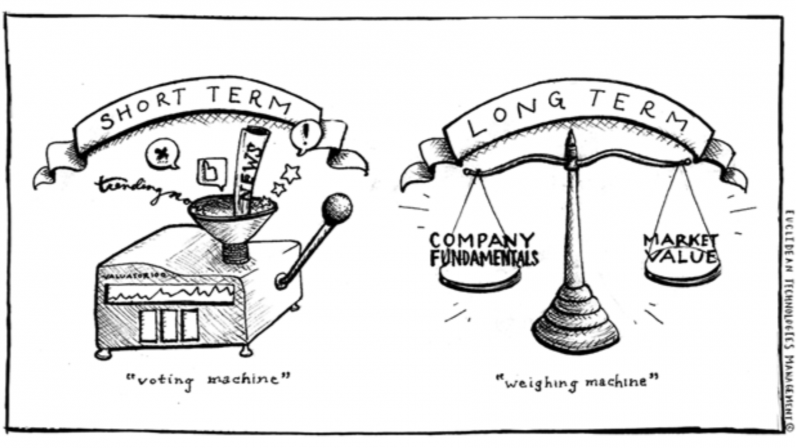

"In the short term, the market is a voting machine, but in the long term, it’s a weighing machine."

This quote, attributed to Benjamin Graham and often cited by his renowned student Warren Buffett, captures the essence of market behavior: short-term fluctuations are driven by opinion, while long-term trends reflect financial results.

In the short term, the market acts as a voting machine. Stock prices respond to popularity, trends, and emotional reactions. Decisions are often based on perception, speculation, and herd mentality rather than thorough analysis.

Over the long term, however, the market becomes a weighing machine, ultimately reflecting the true value of businesses. Financial fundamentals such as profitability and real growth take precedence and drive long-term shareholder returns.

This quote serves as a timely reminder for investors: do not be swayed by fear and short-term noise. Focus instead on long-term fundamentals. What held true in 1995 remains just as valid today.

In the long run, a well-managed, competitive company purchased at a reasonable price will grow its earnings and reward its shareholders, whether publicly traded or privately held.

That is why, for the past 30 years, the investment team at Allard, Allard & Associés has focused its efforts on identifying and evaluating quality businesses (see our definition of quality) at reasonable prices. We remain convinced that as long as capitalism endures, our approach will continue to be effective, prudent, and sustainable.