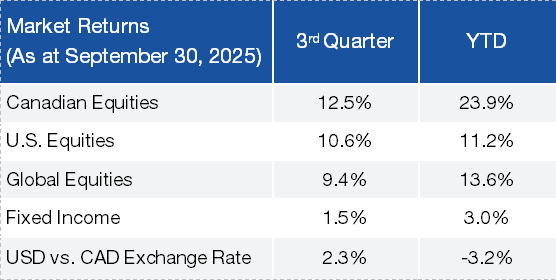

Third Quarter 2025 Summary

Equity markets delivered strong returns during the quarter, supported by expectations of monetary easing from central banks, continued demand linked to artificial intelligence, and a relative easing of trade tensions.

Bond markets also advanced, benefiting from interest rate cuts that led to higher bond prices.

Canadian Equities

With a 12.5% gain, the S&P/TSX Composite Index was among the best-performing markets globally in the third quarter. The strongest contributors came from the natural resources and financial sectors. Bank stocks rose on the back of solid earnings despite an uncertain economic backdrop, while gold-related equities continued to soar, boosted by an increase in price of nearly $500 USD per ounce of gold.

Global Equities

Global equities also posted strong gains (+9.4% in CAD), driven by expectations of an interest rate–cutting cycle and sustained momentum in AI-related names. Europe recorded more modest returns, constrained by lingering political and trade uncertainty. In contrast, emerging markets, particularly China and several Asian economies tied to semiconductor and AI supply chains, outperformed the broader index. These markets benefited from easing trade tensions and supportive government policies.

The gap between growth and value styles remained wide: growth stocks, especially mega-cap technology names, continued to outperform, although a reversal in favour of value was observed toward the end of the quarter.

RETURNS ON MAJOR ASSET CLASSES (CAD)

Fixed Income

Economic data remained mixed, showing signs of slower growth and a softening labour market. However, these factors were offset by encouraging corporate profitability trends. The Bank of Canada lowered its policy rate to 2.5%, providing support to risk assets and contributing to tighter corporate credit spreads. The Canadian bond market rose 1.5% in the third quarter, benefiting from lower interest rates and narrowing spreads on corporate bonds.

The Gold Rally – How Sustainable Is It?

GOLD PRICE TREND SINCE 1975 ($USD)

Canada is one of the world’s largest gold producers. As such, gold plays an important role in our economy and in our stock market. Its significance has grown since the beginning of the year: the gold subsector has surged 115%, and because it represents nearly 13% of the Canadian market’s capitalization, this alone explains roughly one-third of the market’s total return thus far this year.

A Few Facts About Investing in Gold:

No Productivity

Unlike businesses, rental properties, or fixed-income securities, gold produces nothing.No Compounding Returns

Gold does not reinvest earnings, and diversified portfolios have consistently outperformed gold over multi-decade periods.Emotion-Driven Pricing

The price and demand for gold are heavily influenced by fear, inflation, and geopolitical uncertainty.Irrational Demand

It is estimated that less than 10% of global gold production is used for industrial purposes (mainly in electronics and medical technology). More than 90% of demand is therefore driven by non-productive, often emotional factors.

We share Warren Buffett’s long-standing skepticism toward gold as an investment. His main argument is based on the idea that gold is a non-productive asset: it generates no income, no dividends, and no cash flow. Its owner can only hope to sell it later at a higher price to someone else.

Since our founding more than 30 years ago, we have never held gold-related securities, and this discipline has served us well. Although the gold sector has occasionally outperformed, it has underperformed the broader market over the long term.

Outlook

Equity valuations remain highly uneven. The ten largest U.S. stocks are trading at a 50% premium to their historical averages, while most other equities, including value and small-cap stocks, are trading only slightly above their long-term averages.

We remain confident in the long-term return potential of the companies held in our portfolios. They are profitable, have strong balance sheets, trade at reasonable prices, and possess robust cash flow generation capabilities.

Author(s)